Investment Overview

- Total Investment: $1.8 Million

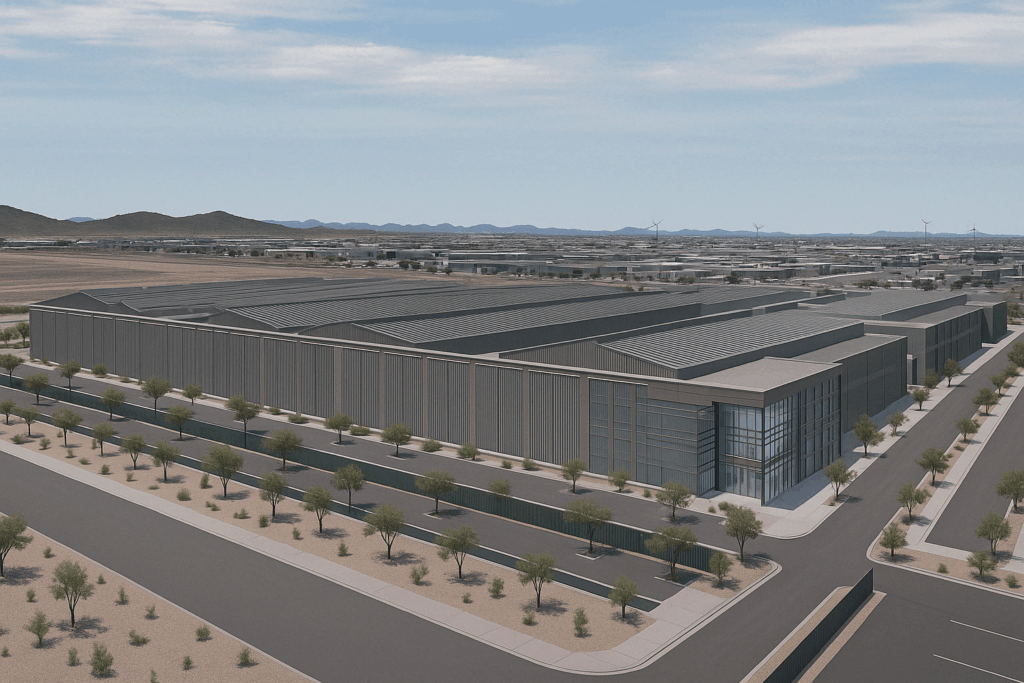

- Description: 100% founder-funded purchase and development of a medical facility in Scottsdale, Arizona.

Investment Strategy

- Acquisition: Strategically acquired land in Scottsdale, AZ, based on market analysis indicating strong demand for medical facilities, leveraging local demographic trends and economic growth factors.

- Value Creation: Managed end-to-end development, including comprehensive tenant improvements, to create a state-of-the-art medical facility. Enhanced property value through targeted capital improvements designed to attract premium healthcare tenants and optimize rental yields.

Key Results

- Tenant Improvement: $943K

- Property Valuation Appreciation: 223%

- Investor Returns: 35% IRR | 9.0x Equity Multiple

Conclusion

This Scottsdale development project exemplifies Strand Capital’s strategic approach—identifying undervalued opportunities, implementing targeted enhancements, and positioning assets for maximum return. The successful execution, from acquisition through development and tenant improvements to final disposition, aligns seamlessly with Strand Capital’s commitment to disciplined investing, thoughtful value creation, and delivering robust investor outcomes.

Figures shown exclude transaction fees, taxes, and related expenses. Past performance does not indicate future results. Please see our Terms and Conditions