Key Highlights

- Durable markets are delivering ~1.5% higher cap rates in 2025–26.

-

These markets combine higher income with lower volatility.

-

Fundamentals, not momentum, are driving outperformance.

Intro

If you charted real estate yields against risk today, you’d notice a pattern: the ‘flashy’ markets fall short, and the overlooked ones stand tall.

A growing yield gap is emerging between momentum-driven cities and what some call durable markets, places where local incomes, supply discipline, and demographic steadiness anchor performance. In 2025-26, these durable metros are offering 1.5% higher cap rates on average, often with lower risk. It’s not just about better income today, it’s about resilience when the market turns.

Cap Rates vs. Risk (2025–26)

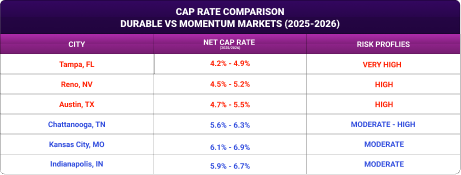

The table below compares six U.S. markets across two key dimensions: projected net cap rates and qualitative risk levels.

Durable markets like Kansas City, Indianapolis, and Chattanooga offer higher yields (6%-7%) alongside moderate risk profiles. In contrast, momentum markets such as Tampa, Reno, and Austin deliver lower cap rates with significantly higher risk.

This ~1.5% yield spread underscores a broader shift: markets grounded in local fundamentals are producing better risk-adjusted returns than those driven by momentum alone.

What Makes a Market Durable?

Durable markets aren’t defined by headlines. They’re built on real economic footing:

- Affordability: Rents and home prices remain in line with local incomes.

- Supply elasticity: Development stays disciplined, avoiding oversupply risk.

- Demographic health: Steady population growth, household formation, and job creation drive long-term demand.

These conditions create markets that aren’t just higher-yielding, but more defensible in downturns. They’re less reliant on speculative growth and more anchored in everyday fundamentals.

Spotlight: Kansas City, MO

Kansas City is a strong example of a durable market. While recent multifamily deliveries have been substantial, they’ve been largely absorbed without major disruption, and overall occupancy remains healthy. Rent growth has continued at a steady pace, up over 3% year-over-year (Yardi Matrix, August 2025), underscoring resilient demand. These trends, though centered on multifamily, reflect broader market fundamentals that also support single-family rentals: disciplined development, positive net migration, and a diversified local economy.

Why This Matters

In a market where capital is becoming more selective, fundamentals are back in focus. High-growth cities may still have appeal, but many carry lower income yields and higher volatility. The cap rate premium in durable markets isn’t just a number; it’s a signal.

It means better cash flow, steadier performance, and a stronger cushion when cycles shift.

Our proprietary StrandScore™️ algorithm evaluates these fundamentals quantitatively, screening for affordability, wage growth, supply elasticity, and other key indicators. But the core idea is simple: when you invest where income and demand are real, you compound more predictably over time.

Conclusion

Not all markets are created equal. Right now, the ones offering higher income and lower risk aren’t making headlines. But they may offer the clearest path to long-term, compounding value.