Key Highlights

-

Millennials still want to own homes, but face a much harder path than previous generations.

-

Homeownership rates for millennials lag far behind boomers and Gen X at the same age.

-

Affordability pressures, student debt, high prices, high monthly payments—are the biggest barriers.

-

Entry-level housing shortages and delayed life milestones widen the ownership gap.

-

Rising demand for rentals, co-living, and build-to-rent creates strong investor opportunities.

-

Millennial and Gen Z lifestyle preferences favor amenity-rich, flexible, mixed-use communities.

-

Aligning investment strategies with these demographic shifts positions Strand Capital for outsized returns.

Are Millennials Abandoning the Dream of Homeownership?

Millennials (born 1981–1996) remain invested in the idea of homeownership, but their path continues to differ sharply from earlier generations. At age 27–30, ownership rates trail far behind their parents’ cohorts. For example, only about one-third of today’s 27-year-olds own a home (32.6%), compared with roughly 40% of baby boomers when they were the same age. This gap reflects affordability pressures and evolving housing dynamics, not a lack of desire for homeownership.

Economic Headwinds

Student debt and high housing costs remain major barriers. Nearly two-thirds of non-homeowning millennials say student loans delay their ability to buy. Meanwhile, home prices, mortgage rates, insurance, and labor costs have climbed faster than wages. By early 2024, the typical monthly home payment reached about $2,800, an all-time high. These conditions make saving for a down payment and qualifying for a mortgage more challenging than in previous decades.

Comparing Millennials to Previous Generations

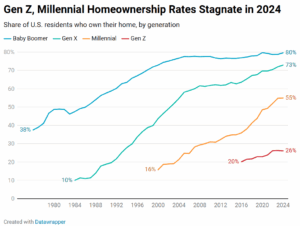

Newer generational data reinforces the long-standing gap in homeownership:

- Millennials: 54.9% owned their home in 2024 (essentially flat from 2023).

- Gen X: 72.9%

- Baby Boomers: 79.6%

When comparing generations at the same age, the gap remains:

- At age 27

- Gen Z (2024): 32.6%

- Gen X (at 27): 38.4%

- Baby Boomers (at 27): 40.5%

- At age 35

- Millennials (2024): 56%

- Gen X (at 35): 59.4%

- Baby Boomers (at 35): 61.5%

These differences reflect delayed life milestones, heavier student debt burdens, and a shortage of affordable entry-level homes, not an abandonment of homeownership, but a slower, more difficult path toward it.

What This Means for Investors

For investors, these trends present clear opportunities. Rising demand for rentals, co-living, and build-to-rent communities is driven by the financial constraints and lifestyle preferences of younger buyers. Amenity-rich neighborhoods, suburban infill locations, and mixed-use developments are well-positioned to meet this demand. Understanding the financial pressures and mobility patterns of millennials and Gen Z helps investors anticipate rental growth and identify strong markets for single-family rental portfolios.

Conclusion

Despite affordability challenges and economic uncertainty, most millennials still see homeownership as a core life goal, according to Realtor.com’s 2025 American Dream survey. Their route to ownership, however, differs from previous generations: many prioritize flexibility, amenities, and locations that support modern lifestyles and remote work.

At Strand Capital, we view these shifting preferences as an opportunity. By aligning investment strategies with evolving demographic trends, we can deliver strong returns while meeting the housing needs of younger generations. Monitoring affordability, supply constraints, and lifestyle shifts will remain essential as the next phase of U.S. housing demand unfolds.