Key Highlights

-

Resilient Asset: SFRs hold steady in recessions because housing is a necessity.

-

Strong Occupancy: ~95–98% occupancy even during 2008 and COVID downturns.

-

Tenant Stability: Longer stays (avg. 4 years) and higher retention (~70%).

-

Attractive Returns: ~8–9% annual returns with far less volatility than stocks.

-

Historical Proof: SFRs outperformed equities in both 2008 and 2020.

-

Diversification: Moves independently of stocks, adding portfolio balance.

-

Strand Capital Edge: Data-driven model compresses 7–10 year returns into ~3 years with 20–50% IRRs.

Introduction

Single-family rental (SFR) homes have emerged as a safe-haven asset during recessions. Unlike speculative assets, housing provides a basic need (shelter) and often maintains high occupancy and steady cash flow even when the economy slows.

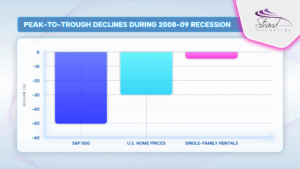

For example, U.S. Census Bureau data show SFR occupancy rates averaging around 95% over time; in mid-2024 occupancy was ~94.6%. By contrast, commercial real estate and stocks can experience sharp swings in a recession. During the 2008–09 Great Recession, U.S. housing prices fell roughly 30% while the S&P 500 plunged by about 50% (Federal Reserve Bank of St. Louis, 2017). Even so, rental homes fared better than stocks, because rent collections continued despite price drops. In the COVID-19 downturn of 2020, major SFR REITs reported record occupancy (~97–98%) and rent collection rates near 98%, while equities were highly volatile (Invitation Homes, 2020).

Why Single-Family Rentals Hold Up in Recessions

Key advantages of SFRs include:

- Necessity-driven demand: Shelter is a basic human need. Demand for rentals holds steady even when jobs are cut or mortgage credit tightens.

- High occupancy and stable rents: National studies (CoreLogic, 2020) found single-family rents rising 3–4% year-over-year even as apartment rents fell in recessionary periods.

- Tenant and income stability: Industry data show single-family tenants stay an average of four years, compared to about two years for multifamily. Retention rates are around 70% versus 50% for apartments (Altus Group, 2022).

- Attractive return profile: Research by the National Bureau of Economic Research (2019) found SFR investments averaging ~8.5% annual total returns across U.S. cities, split between rent yield and appreciation. Importantly, volatility was low: the worst year in the study showed –2.5% returns, versus –35% in the S&P 500’s worst year over the same period.

Historical Performance vs. Other Asset Classes

- 2008–09 Great Recession: U.S. home prices declined ~30% while the S&P 500 lost about half its value (Federal Reserve Bank of St. Louis). Rental homes maintained ~95% occupancy.

- 2020 COVID slowdown: While the S&P dropped ~34% in March–April 2020, large SFR portfolios reported ~98% rent collection and rising occupancy (Invitation Homes, 2020).

- Volatility comparison: Over 1992–2017, academic studies found single-family rentals had equity-like returns (~8–9% per year) with far smaller drawdowns than equities (NBER, 2019).

Data-Driven Acceleration: Our Approach

While SFRs are inherently recession-resistant, we’ve built a strategy to accelerate returns. Using our proprietary StrandScore™️, which analyzes thousands of simulations and data inputs, from demographics to supply-demand imbalances, we identify U.S. metros with the strongest rental growth potential.

This process produces a dynamic, high-impact set of factors that work cohesively to pinpoint markets with optimal conditions for rental growth and long-term appreciation. The platform is designed to compress the traditional 7-to-10-year return timeline into as little as three years, creating earlier exit opportunities and faster capital recycling for investors. Project-level case studies show IRRs ranging from ~20% to over 50% on 2–4 year holds. Our methodology applies hedge-fund-style quantitative modeling and rigorous data science to real estate decisions.

Takeaways for Investors

- Cash flow consistency: Rentals provide reliable income during downturns.

- Downside protection: Housing values are steadier than equities, even in crises.

- Diversification: SFRs move independently from stocks, offering portfolio balance.

- Data-driven edge: At Strand Capital we demonstrate how analytics can amplify SFR performance, unlocking faster exits and stronger returns.