Key Highlights

-

Housing affordability is broken, Boomers dominate buying, younger buyers are priced out.

-

Millennials & Gen Z are driving long-term SFR demand instead of homeownership.

-

High rates + low inventory make renting the only viable path for under-35 households.

-

Strongest returns lie in affordable, high-growth Sun Belt & Midwest markets.

-

SFR/BTR wins as a structural, decade-long demand trend, exactly where Strand Capital focuses.

Introduction

America’s housing market isn’t just cooling. It’s becoming a market that only one generation can truly afford to play in. Boomers, armed with decades of equity, cash reserves, and stronger balance sheets, are dominating home purchases in record numbers. Meanwhile, Millennials and Gen Z are aging into their prime buying years… with nothing affordable to buy.

This generational split is no longer a talking point. It’s becoming one of the clearest drivers of where demand, and returns, are headed.

Older buyers are winning - decisively

Today’s “typical” homebuyer is pushing 60 years old. First-time buyers, once in their early 30s, are now around age 40. The reason is simple: affordability has broken.

Boomers and older repeat buyers hold decades of home equity, often buy without financing, and can move quickly on limited inventory. They’re the only participants who can consistently outbid in a market defined by high rates and tight supply.

Younger buyers cannot keep up, not because they don’t want to buy, but because the math no longer works.

Millennials and Gen Z are renting - and the SFR market is absorbing the demand

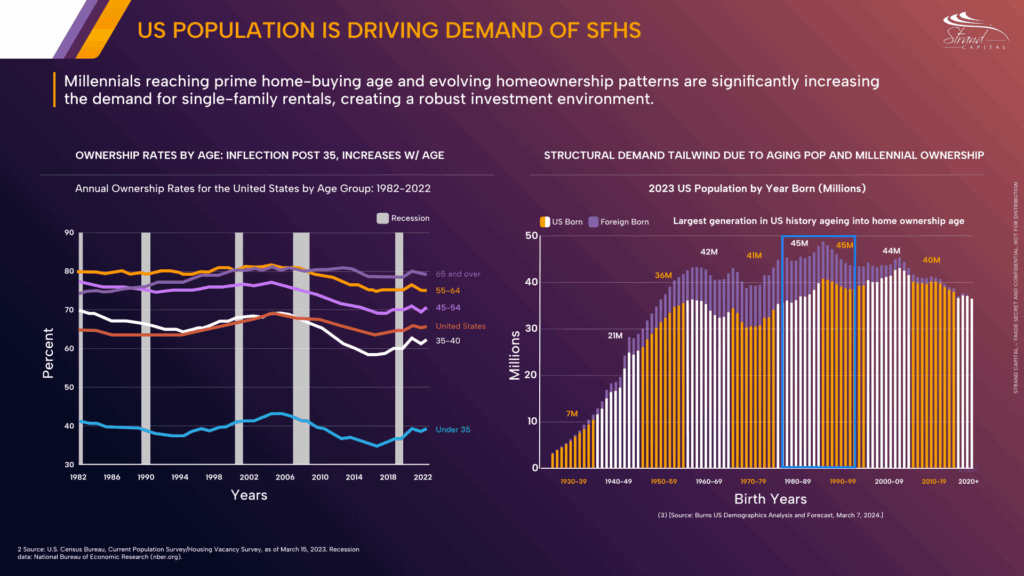

Millennials are the largest generation in U.S. history. They’re forming households, growing families, and searching for stability. But instead of buying, they’re overwhelmingly renting single-family homes.

Three forces explain why:

- High mortgage rates + record prices make ownership unattainable.

- Low inventory keeps starter homes out of reach.

- Flexibility matters, remote work, job mobility, and geographic arbitrage are reshaping lifestyle preferences.

The result: under-35 households are becoming a durable, long-term engine of demand for Single-Family Rentals (SFR).

This is not a temporary shift, it is a structural realignment.

As the charts below show, homeownership only begins to rise after age 35, while the largest generation in U.S. history is currently sitting below that threshold. This mismatch is one of the clearest structural drivers of SFR demand today.

The affordability crisis is reshaping where returns are strongest

The generational imbalance is telling investors something extremely important:

Housing demand is strongest where younger renters can live, not where they can buy.

For capital allocators, that means three clear opportunities:

1. Prioritise SFR and Build-to-Rent (BTR) exposure

Professionally managed homes with predictable pricing, modern amenities, and strong operational oversight will continue to see high occupancy and resilient rent growth.

2. Focus on markets with demographic tailwinds + relative affordability

Mid-tier Sun Belt and select Midwest metros, places with strong job magnets but still-unlocked price points, are positioned to capture the bulk of young renter demand.

3. Operate better, not just buy better

Smart home tech, good maintenance, pet-friendly policies, and community design are not “extras.” They are competitive advantages that keep turnover low and NOI stable.

A demographic blueprint for reliable returns

The generational split in homeownership isn’t just a concerning statistic. It’s a roadmap for where capital should go.

Older buyers may dominate homeownership, but younger households are defining the rental market, and they represent a decade-plus runway of steady, dependable demand. Investors who align with this demographic convergence stand to benefit from one of the most predictable themes in U.S. housing today.

At Strand Capital, this is precisely where we focus:identifying markets and assets positioned to capture durable, demographic-driven demand in the SFR sector.